The drawdown metric essentially logs the account’s decline in performance and is also used to showcase the risk that is being taken while trading the account. There are several factors that contribute to the drawdown value:

End-of-day Drawdown

At the end of each day, if you have any trades left open, our system will capture your equity and floating losses will be recorded as drawdown

Intraday Drawdown

Each time your account updates, the equity of the account during the update is captured and floating losses will be recorded as drawdown

Growth Drawdown

Each day’s gain is compared to the highest gain achieved prior to this day using the TWR formula. Negative differences are recorded as drawdown

The highest value out of the three will appear as your account’s drawdown while only the end-of-day and growth drawdown values are used in the drawdown chart.

End-of-day Drawdown example

Click here to see an example

A trader has an account balance of $1,000.

The trader opens 5 trades on the Monday and keeps them open until Wednesday.

By the end of Monday these trades have an overall floating loss of -$100. This floating loss is recorded as a drawdown of 10%. Since this is the highest drawdown the account has ever experienced, this 10% value will show as the drawdown under the ‘Stats’ section and also in the drawdown chart.

By the end of Tuesday these trades’ performance slightly improve and the floating loss recorded is -$80. This translates to 8% drawdown which is lower then the value last recorded in the ‘Stats’ section, therefore, the drawdown of the account will remain 10%, however, the value in the drawdown chart for Tuesday will log the 8% drawdown (if it’s the highest drawdown of the day)

On Tuesday the trades are closed during the day, so there will be no end-of-day data for this day since no trades were left open when the day ended.

Intraday Drawdown example

Click here to see an example

A trader has an account balance of $1,000.

The user connected his account to Myfxbook using the EA publisher method so his account updates every 5 minutes.

5 minutes after opening the trades, the account updates and the trades are currently at a floating loss of -$10 which translates to 1% drawdown. If this is the highest drawdown the account has experienced, this 1% value will show as the account drawdown under ‘Stats’. However, Intraday drawdown doesn’t show up in the drawdown chart.

After another 5 minutes the account update logged a floating loss of -$50 which translates to 5% drawdown and since this value is higher then the last recorded drawdown value, the account drawdown will now show 5% drawdown.

Growth Drawdown example

Click here to see an example

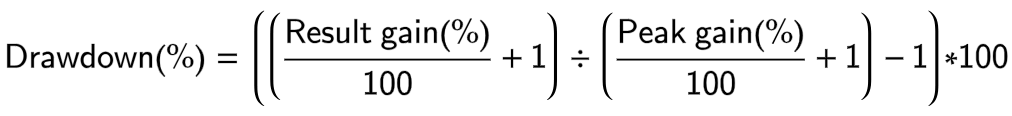

A trader has reached a maximal gain of 40% on Sunday, but since then, he experienced some losing trades which affected his gain – on Monday the gain value was 30% and on Tuesday it was 35%. Using the TWR formula we can calculate the negative gain difference (drawdown) between the peak gain (40%) and the lower gain on the days that follow.

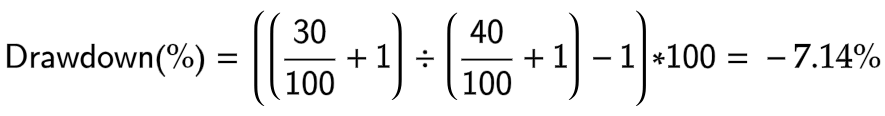

So the growth drawdown calculation for Monday will look like this:

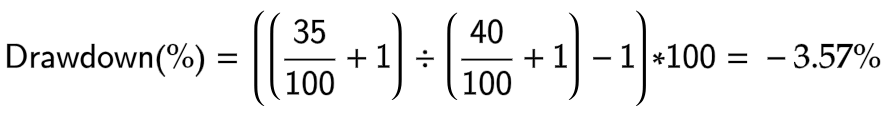

And for Tuesday: